YOUR PREFERRED GUARDIAN FROM START-UP TO PRE-IPO

WE HAVE CREATED COUNTLESS BRILLIANT RECORDS IN BUSINESS FUNDING & BUSINESS ADVISORY FOR THE PAST 20 YEARS

Who Are We?

Why Engage With Us?

Customize Your Financing Solution Quickly and Efficiently

Reducing The Possibility of Loan Rejection

Expedite The Process of Disbursement

Enhancing Your Possibility of Loan Approval

Responsible and Confident Assurance

Our Track Records

Since 2004, we achieved:

100% Approved

>20Years

>12,810 Approval

>7,405 Millions Fund Disbursed

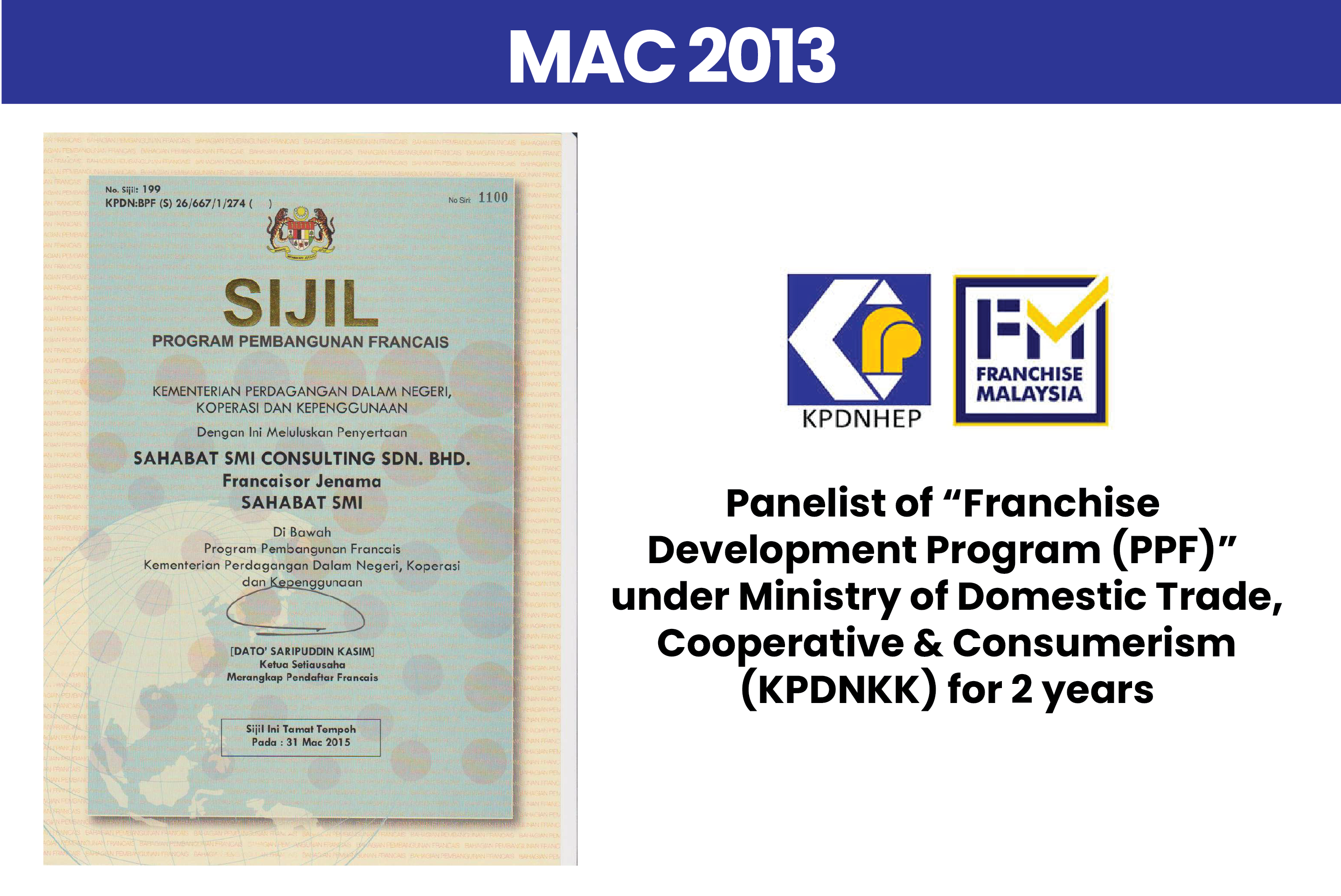

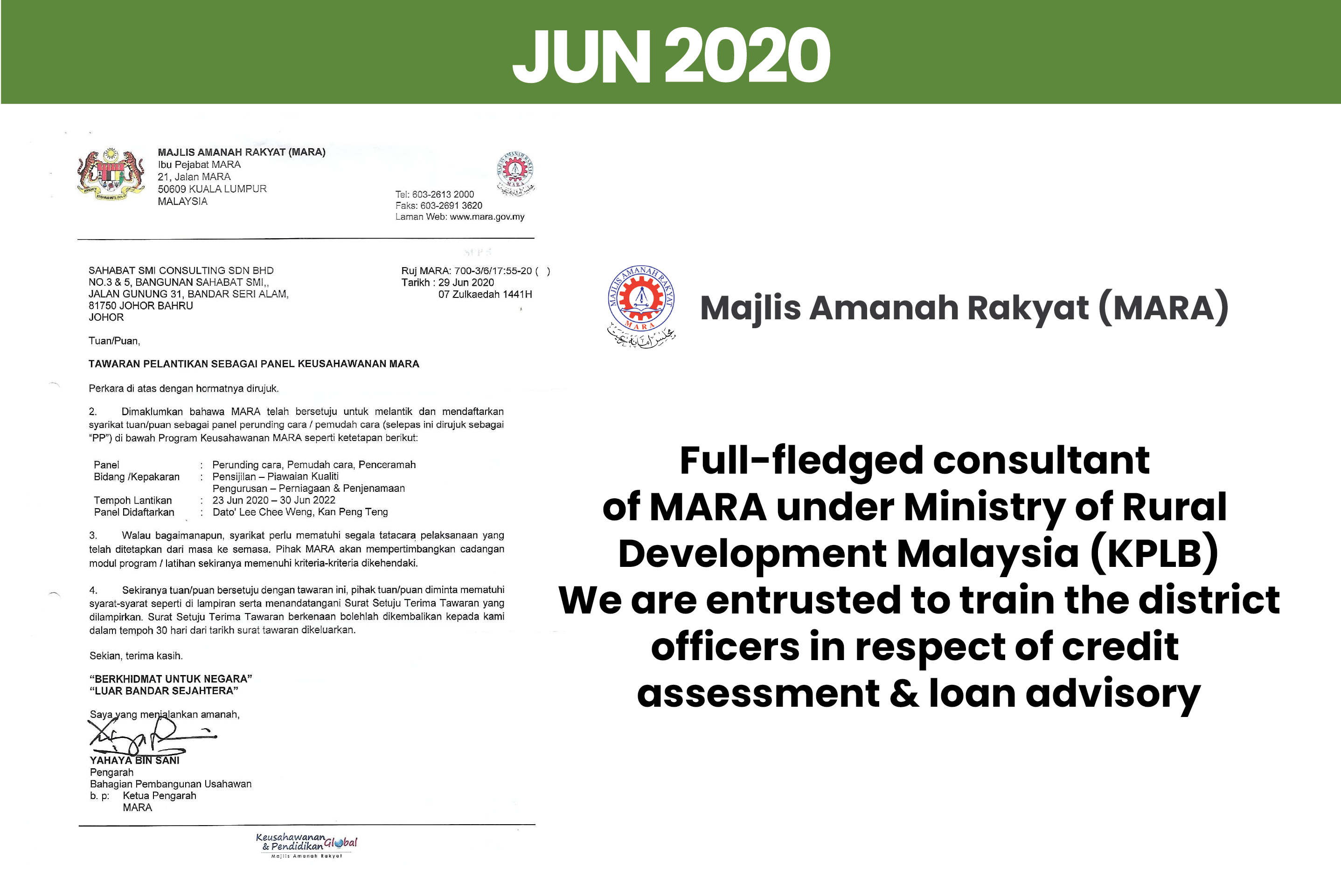

Most Government Endorsements

Platform of Highly Knowledgeable, Exceptionally Informative & Distinctly Connected People

Trained Many Popular Loan Consultants and Credit Officers

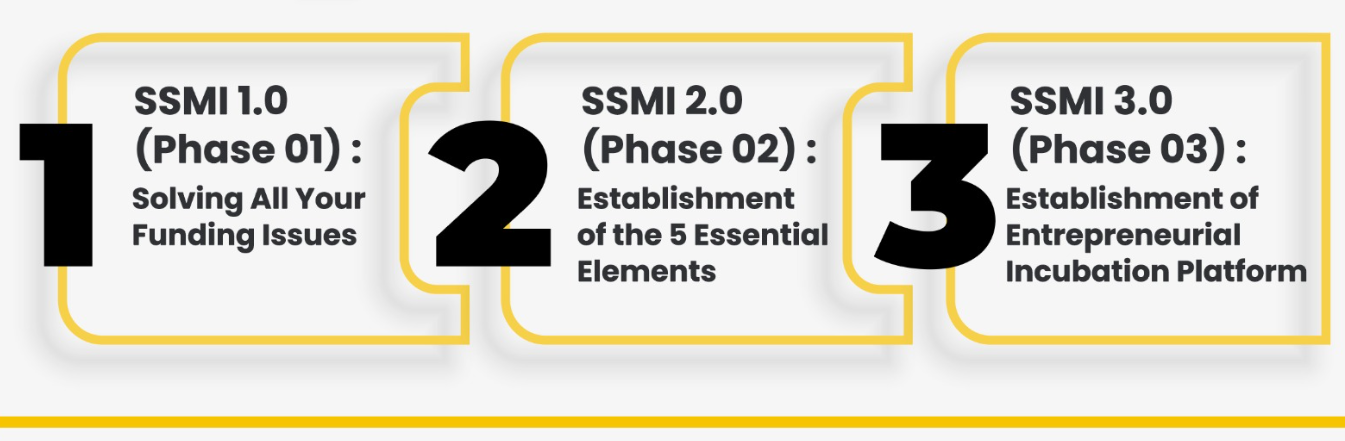

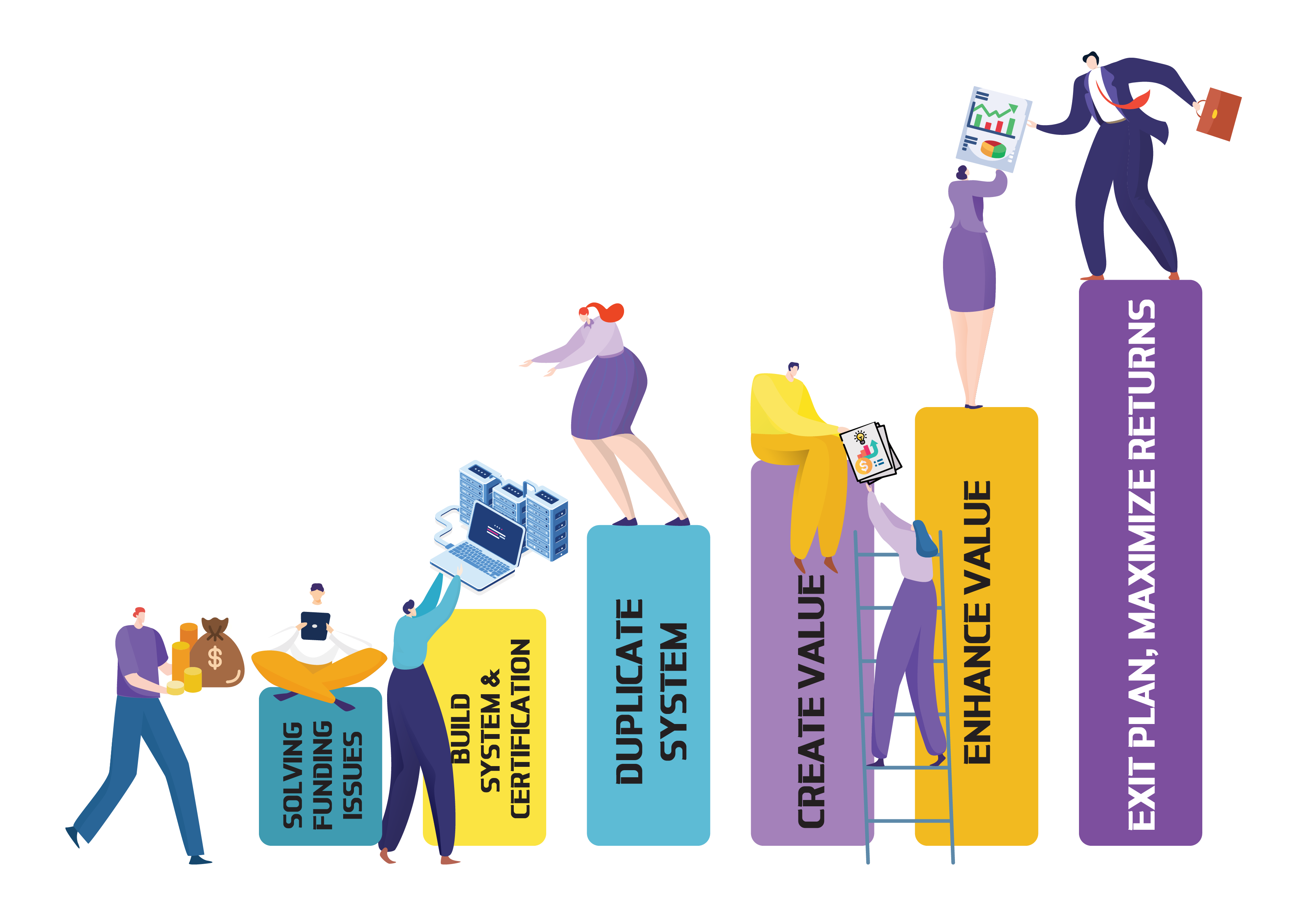

SSMI 1.0 (Phase 01) : Solving All Your Funding Issues

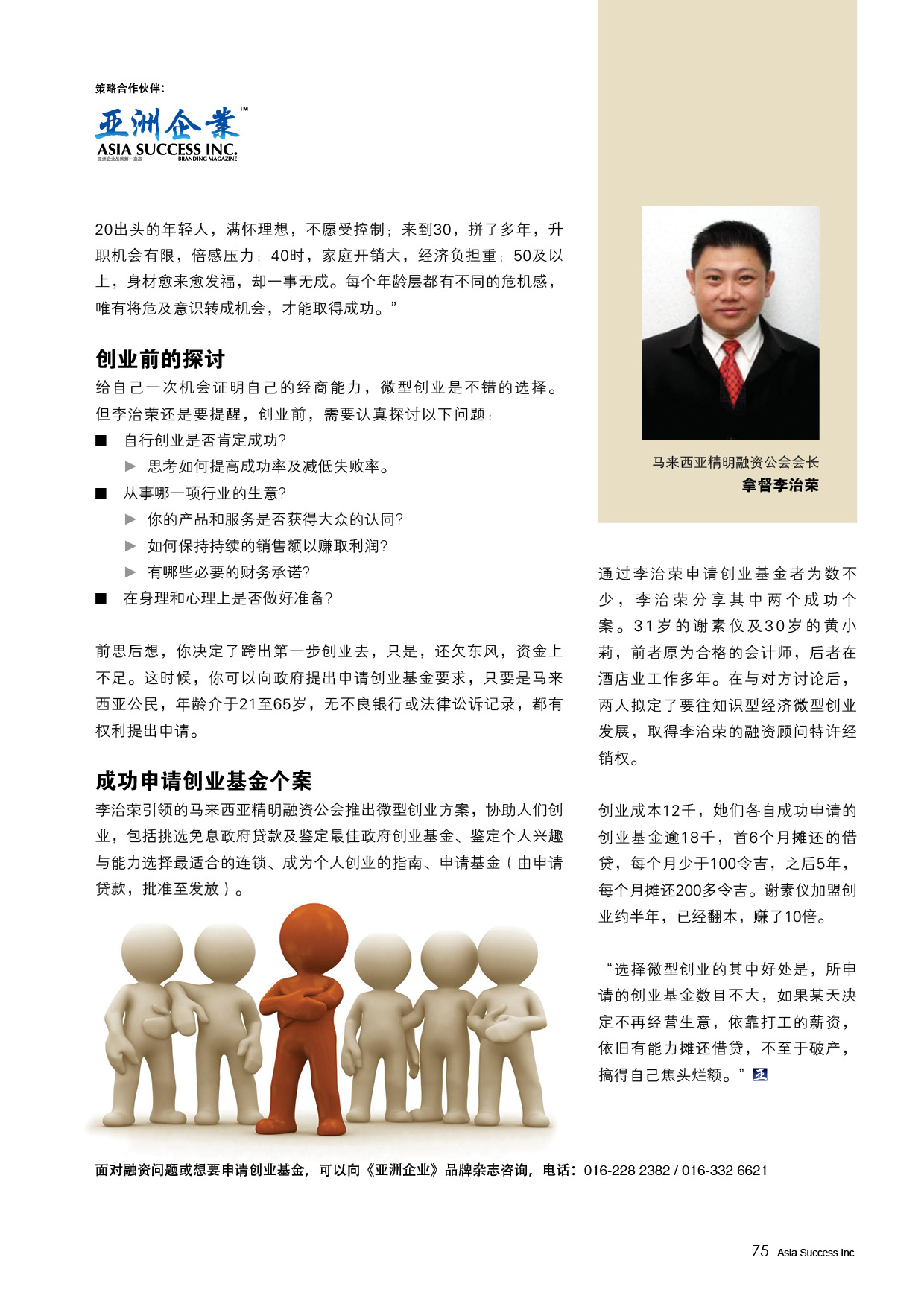

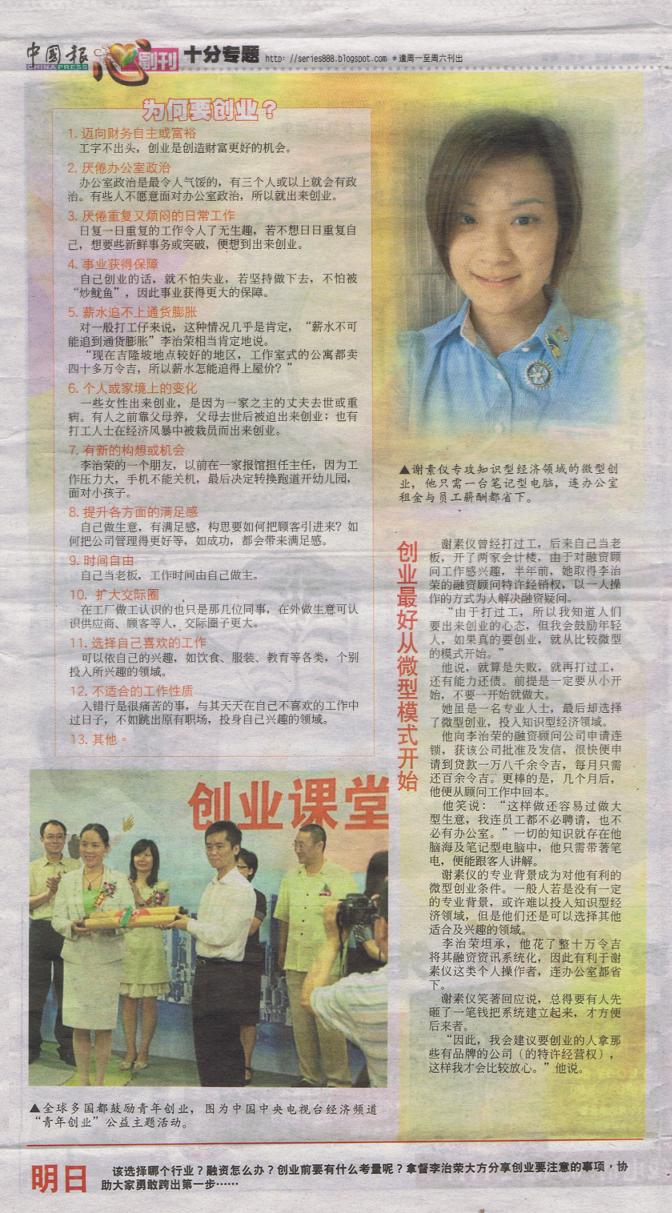

Since 2004, SAHABAT SMI Consulting has consistently set industry standards, achieving numerous records and milestones, inspiring others to strive for excellence. With over 12,000 cases approved and RM7 billion in value, they've embarked on a transformative Phase 2, recognizing that business success involves more than just financing.

SSMI 2.0 (Phase 02) : Establishment of the 5 Essential Elements

Since 2004, SAHABAT SMI Consulting has consistently set industry standards, achieving numerous records and milestones, inspiring others to strive for excellence. With over 12,000 cases approved and RM7 billion in value, they've embarked on a transformative Phase 2, recognizing that business success involves more than just financing.

SSMI 3.0 (Phase 03) : Establishment of Entrepreneurial Incubation Platform

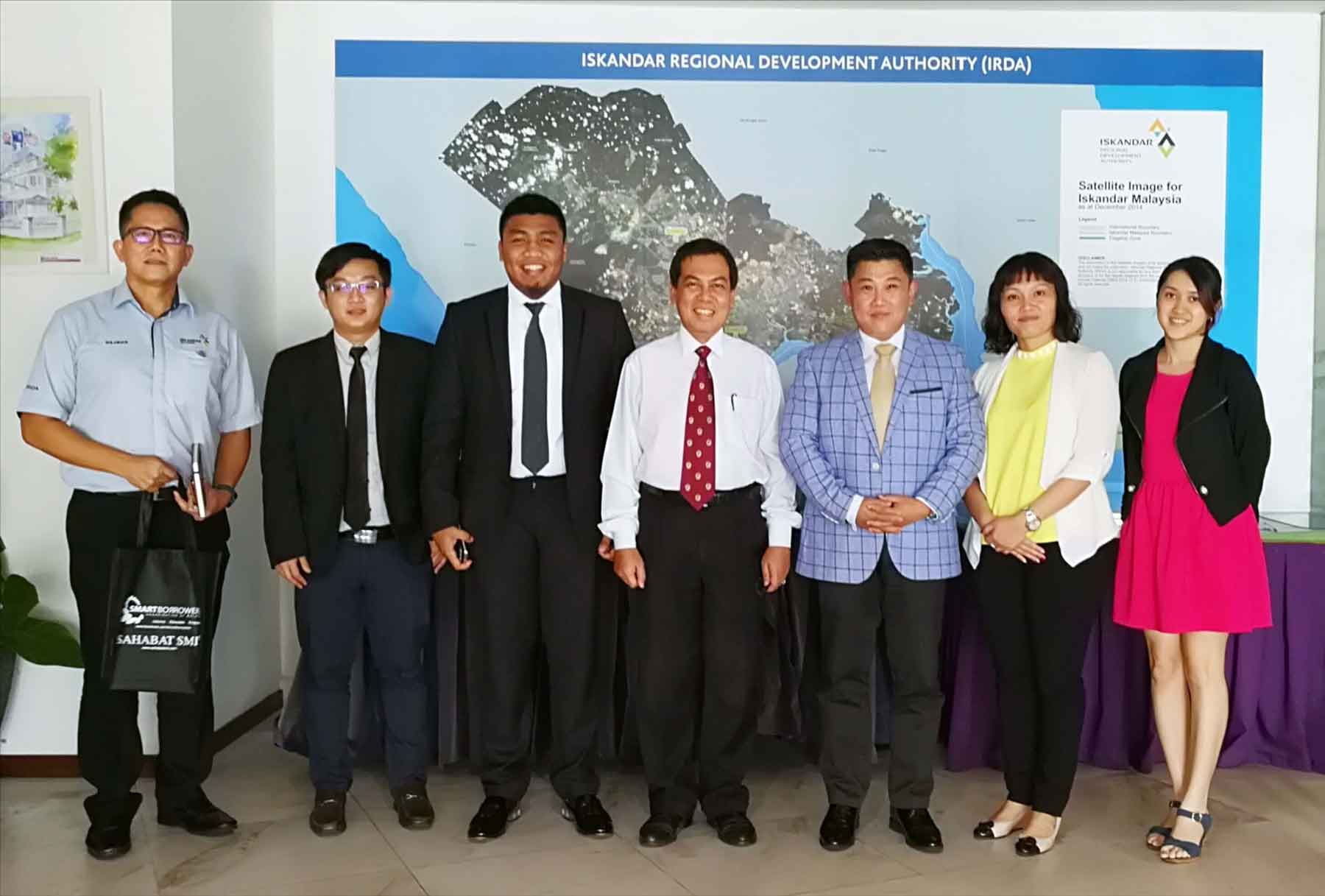

Leveraging years of successful experience and strong government ties, SAHABAT SMI ® has built trust with Entrepreneur Development Agencies. With a robust resource integration platform, they invite trustworthy entrepreneurs to join and contribute to the economy's growth.

Our Videos

Corporate Video

Our Testimonials